Have you ever thought why the government needs foreign currency when the people are still residing in India? Let’s understand this through an example if a person is residing in India and wants to go abroad for the purpose of the job, travelling, education, migration or any other reason requires foreign currency. Similarly, if a person residing outside India and for similar purposes wants to come here then the person requires Indian currency. If an Indian resident goes outside then i.e. outflow of the foreign currency and the person visiting India then that is the inflow of the foreign currency. To manage and balance this inflow and outflow of the foreign currency is the objective. RBI is the governing authority for this management. For this reason, this Act is named as Foreign Exchange Management Act, 1999.

Foreign Exchange Regulation Act, 1973 (FERA) was replaced by the Foreign Management Act, 1999 (FEMA). FEMA was enacted by Parliament of India and it came into force on 1st June, 2000. There are a total of 49 Sections divided into 7 chapters. The reason for the replacement emerged because it was not suitable for the prevailing environment and was harsh as it contained a provision for imprisonment.

On the other hand, FEMA was introduced with the changes because of the new, liberal and changing environment.

Also, earlier FERA was passed due to the insufficient foreign exchange in the country and FEMA was passed with the objective to relax the controls on foreign exchange in India.

The head office of FEMA is situated in New Delhi known as Enforcement Directorate and is headed by a Director.

In general, FEMA includes three different types of categories and deals separately which are:-

Now let’s discuss them in detail.

For the object of the Act, a person includes the following:-

B. Any person or body corporate registered or incorporated in India.

C. An office, branch or agency in India owned or controlled by a person resident outside India.

D. An office, branch or agency outside India owned or controlled by a person resident in India.

It means a person who is not an Indian resident or not a resident in Indian.

It means any currency but other than Indian currency.

It means foreign currency and it also includes deposits, credits, and balances which are payable in foreign currency. Also the drafts, travellers cheques, letters of credit or bills of exchange which are expressed or drawn in Indian currency but is payable in any foreign currency.

Also, the drafts, travellers cheques, letters of credit or bills of exchange drawn by banks, or any institutions or person outside India but are payable in Indian currency.

It means any security which is in the form of shares, stocks, bonds, debentures or any other instrument denominated or expressed in foreign currency. It also includes foreign securities which are denominated or expressed in foreign currency, but where the redemption or any form of return on these securities such as interest or dividends should be payable in Indian currency.

Section 2(c) of the Foreign Exchange Management Act,1999 defines Authorised person. An authorised person is a person who has given the authority for the conversion of the foreign exchange.

For example, if an Indian resident wants to visit the USA and requires their currency which is dollars so for the exchange he/she will only go to the authorised person or if a person residing abroad wants to visit India and requires Indian currency then similarly he/she will approach an authorised person for the foreign exchange.

The Reserve Bank on an application made on this behalf may authorise any person to deal in foreign exchange or in foreign securities. So, an authorised person is governed under this section which states 4 persons as an authorised person-

Section 10 of the Act in brief

The Reserve Bank may order an authorised person to comply with a general or special direction to deal with the foreign exchange or foreign securities.

And also if any transaction which involves any foreign exchange or foreign currency which is not in compliance with the terms of this provision then an authorised person without any prior permission from the Reserve Bank must not engage in any type of this transaction.

Before undertaking any transaction in foreign exchange on behalf of any person an authorised person shall require the declaration or information of that person that the transaction is not designed for the purpose of contravention of this Act, rule or regulation etc.

If the person refuses to undertake the declaration then an authorised person shall refuse in writing to undertake the transaction and also if the authorised person believes that a person contravenes the provision of the Act can report the matter to the Reserve Bank.

Other than the authorised person, if any person acquires or purchases the foreign exchange and use it for any other purpose which is not permissible under the provisions of this Act or does not surrender within a specified time to the authorised person shall be considered to have committed the violation under the provisions of this Act.

So accounts are broadly classified into:-

Capital account transactions- defined under Section 2(e).

It means the transactions which alter or changes the asset or liabilities, including contingent liabilities, outside India of a person resident in India, or

Alters or changes the asset or liabilities, including contingent liabilities in India of a person resident outside India.

And also includes those transactions which are referred to in Section 6(3) .

The permissible capital account transactions are defined under the following two categories:

For example, Nim, a person resident in India purchases a property in India. Is FEMA applicable to him? The answer to this question is no because there is no involvement of foreign exchange.

To apply FEMA in any transaction the involvement of one person should be from India and the other person should not be a resident in India.

Let’s understand this with another example, Mr. Lucas, a person resident outside India purchases shares of an Indian company. Is FEMA applicable on this transaction? The answer is yes because Mr. Lucas is a person resident outside India and asset and liability is altered of an Indian company then FEMA is applicable.

Current account transaction- defined under Section 2(j) .

It means transaction other than a capital account transaction and includes:-

And any expenditure which is not covered under capital account transaction that will be considered in current account transaction even though it is not mentioned in the above points.

Under this Act, freedom has been provided for selling and drawing of foreign exchange to or from an authorized person for undertaking current account transactions.

However, the Central Government has been vested with powers in consultation with Reserve Bank to impose reasonable restrictions on current account transactions. The Central Government has framed Foreign Exchange Management (Current Account Transactions) Rules, 2000 dealing with various aspects of current account transactions

Restricted transactions include the remittance of lottery winnings, income from racing/riding, purchase of lottery tickets, banned/proscribed magazines, football pools etc.

Also, Nepal and Bhutan allowed the use of Indian currency for local transactions and the citizens of these countries were considered at par with Indian citizens from a legal standpoint. Because of these provisions allowing for a common currency market in India, Nepal and Bhutan, use of forex for transactions in – or with the residents of – Nepal and Bhutan were also prohibited.

Restrictions on dealing in Foreign exchange are mentioned under Section 3 of the Act, the Section reads as-

Further, Section 4 of the Act states that no person resident in India shall acquire, hold, own, possess or transfer any foreign exchange, foreign security or any immovable property situated outside India.

Section 7 of this Act states about the export of goods and services.

Every exporter of goods-

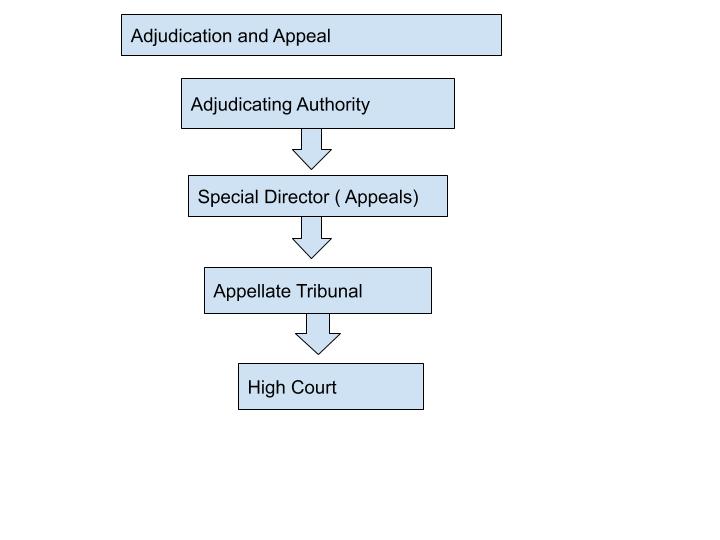

Section 16 states about the appointment of Adjudicating Authority

If the Adjudicating Authority fails to dispose of the complaint within the said or specified period then the Authority should give the reasons in writing.

Section 17 of the Act deals with Appeal to Special Director

If any person files the appeal after the date of the expiry then it is completely up to the Special Director (Appeals) that he may entertain the appeal once he is satisfied that there was sufficient cause for not filing it within that period.

Section 18 of the Act, talks about the establishment of the Appellate Tribunal which says that the Central Government through a notification may establish an Appellate Tribunal for foreign exchange in order to hear the appeals regarding the orders of the Adjudicating Authorities and the Special Director (Appeals).

Section 21 of this Act, states the qualifications, for the appointment of Chairperson, Member Special Director (Appeals).

A person shall only be qualified for the appointment if he:

Was a member of the Indian Revenue Service and held the post equivalent to a Joint Secretary of the Government of India.

Section 28 of the act states that

If any person is dissatisfied with the decision of the Appellate Tribunal he/she may file an appeal to the High Court within sixty days of that communication of the decision or order.

High Court may give a further extension of sixty-days if the Court is satisfied with the reasons for the delay of the appeal filed by the appellant.

Section 36 of this Act, talks about Directorate of Enforcement

Section 37 of the Act states that

If any person contravenes any provision, rule, order, regulation or direction of this Act. The person will be liable to pay the fine for that contravention and thrice the amount which is mentioned in the Act where the violation is measurable or up to two lakh rupees where the amount cannot be determined or measured. Also where such violation is a continuing one then a further penalty will be extended to five thousand rupees every day.

Any Adjudicating Authority adjudging any contravention and if he thinks fit or is satisfied with the violation done then in addition to any penalty he may direct the party who is responsible for this contravention, that any currency, property, security or money in respect of which the contravention has taken place shall be confiscated to the Central Government and further direct that if there are any foreign exchange holdings of the persons committing the contraventions must be brought back into India or must be retained outside India in accordance with the directions made in this behalf.

If any person fails to make full payment of the penalty imposed on him within a period of ninety days from the date on which the notice for payment of such penalty is served on him, he shall be liable to civil imprisonment.

FERA was implemented to regulate foreign payments and to ensure optimum use of foreign currency in India.

FEMA aims to promote foreign trade, foreign payments and to increase the size of foreign exchange reserve in the country.

It is an old enactment and was approved by the Parliament in the year 1973.

It is a new enactment and was approved by the Parliament in the year 1999 and is currently in force.

Number of Sections

It had 81 Sections.

It has 49 Sections divided into 7 chapters.

When this was introduced(position of foreign exchange)

When foreign exchange reserves were very low.

When foreign exchange reserves were adequate but required regulation and balance.

Outlook towards foreign exchange reserves.

A rigid approach was there.

A flexible approach is there.

Determining the residential status

Through citizenship only it was determined.

More than 182 days/ 6 months stay in India.

Transfer of funds

A person has to take permission from RBI relating to the transfer of funds to external operations.

There is no requirement of the pre-approval from RBI regarding the transfer of funds relating to the external operations, funds or trade.

If any violation of the provision or order then it will be considered as a criminal offence.

If any violation of the provision or order then it will be considered as a civil offence.

Punishment for the violation

The guilty person will be sentenced to imprisonment.

The guilty person will be held liable to pay a fine and if the fine is not paid within stipulated time then will be sentenced to imprisonment.

FEMA only permits an authorized person to deal in Foreign exchange or foreign security ( shares, stocks, bonds etc). FEMA became the need of an hour to be replaced by an old act which was FERA as FERA was stringent and FEMA is liberal and also more flexible than FERA.

Any person who wants to do business in a foreign country or to buy foreign securities he/she needs an authorised person to do that and also to understand this Act in order to avoid penalties and he/she should also be aware of the restrictions on it.

The main objective of FEMA was to consolidate and amend the laws relating to the foreign exchange with the reason to facilitate the external trade and payments and for the maintenance of the foreign exchange market in India. FEMA’s replacement with FERA to an extent has boosted the Indian economy as it is flexible and also a civil offence in comparison with FERA.